Best GST Return Filing Services for Hassle-Free Compliance

Introduction : GST Return Filing Service

One of the key features of the GST era is the consolidation of most indirect taxes, which previously required separate returns from various businesses. Now, whether you are a trader, manufacturer, reseller, or service provider, you must file GST returns online using prescribed formats.

Under GST, there are 19 return forms available for taxpayers to file their GST returns electronically. All these forms must be e-filed according to the procedures outlined in the GST return rules section of the GST Act. Below are the details of each GST return format, including their applicability and filing frequency.

What is GST Return Filing?

GST return filing is a mandatory compliance process for businesses that requires submitting detailed information about transactions and tax liabilities. This standardized method is essential for streamlining the Goods and Services Tax (GST) framework introduced in India in 2017.

Filing GST returns involves reporting key details such as purchases, sales, output GST collected on sales, and input tax credit (ITC) on purchases. Registered businesses must file GST returns monthly, quarterly, or annually, summarizing data from invoices, receipts, payments, and other relevant transactions. To avoid penalties, it's crucial to adhere to the specified due dates.

Benefits of Timely GST Return Submission

Timely GST return filing offers several advantages:

- Avoiding Penalties: All registered businesses must file their GST returns online, regardless of tax liability. Late filings incur penalties, with interest rates reaching up to 18% per annum and late fees ranging from ₹100 to ₹5,000.

- Maintaining Compliance Status: Filing returns on time helps avoid scrutiny from the GST department, thereby maintaining a positive compliance status. Inconsistencies can negatively impact business credibility.

- Claiming Input Tax Credit (ITC): Timely filings allow businesses to claim ITC, enabling them to deduct the tax paid on purchases from their total tax liability.

- Benefit from Government Initiatives: Businesses that file GST returns promptly are often eligible for government-backed schemes, which can include faster processing of refunds and exemptions from penalties.

- Improved Business Reputation: Consistent and timely filing showcases a business's commitment to compliance, enhancing its reputation among consumers, partners, and stakeholders.

Documents Required for GST Return Filings

To file GST returns, businesses need the following documents:

- Customer GSTIN

- GST invoices

- Place of supply details

- B2B and B2C service invoices

- Bill numbers

- Credit or debit notes

- HSN summary of goods sold

- Applicable IGST, CGST, and SGST amounts

- Relevant GST return forms

Even if there is no business activity, filing a NIL GST Return is mandatory.

GST Return late filing penalty

As of 2024, late filing of GST returns in India incurs penalties and interest as per the Goods and Services Tax (GST) law. Here's a breakdown of the penalties:

- Late Fee:

- For regular taxpayers, the late fee for filing GSTR-3B is ₹50 per day (₹25 for CGST and ₹25 for SGST), up to a maximum of ₹5,000.

- If there is no tax liability, the late fee is reduced to ₹20 per day (₹10 for CGST and ₹10 for SGST).

- Interest:

- If there is any tax payable, an interest rate of 18% per annum is charged on the outstanding tax amount from the due date until the payment is made.

- Composition Scheme Dealers:

- For dealers under the composition scheme, the late fee is ₹200 per day (₹100 for CGST and ₹100 for SGST), up to a maximum of ₹5,000.

These penalties encourage timely filing and compliance with GST laws. It's important to note that regular late filing can also lead to other consequences, such as the blocking of e-way bills or disqualification from certain schemes.

Step-by-Step GST Return Filing Process

- Get in Touch With Our Experts: Book a consultation with our GST specialists to clarify any doubts. If not registered, ensure timely GST registration.

- Preparing and Updating Invoices: Provide the required documents and fill in essential details such as B2B and B2C invoices, along with ITC details to initiate the filing process.

- GST Return Calculation and Filing: Our team will calculate the GST returns and file them on your behalf through the online portal. You’ll receive an acknowledgment once the returns are filed.

Types of GST Returns and Their Due Dates in 2024

| GST Form | Due Date |

|---|---|

| GSTR-1 | 10th of Every Month |

| GSTR-3B | 20th of Every Month |

| GSTR-9 | Annual, Due on 31 Dec |

| GSTR-9C | Annual, Due on 31 Dec |

| GSTR-10 | Within 3 months of GST cancellation |

| GSTR-11 | As Applicable for UIN Holders |

Penalties for Late GST Return Filing

Non-compliance can result in significant penalties, including:

- Interest at 18% per annum on overdue payments.

- Late fees of ₹100 per day (₹200 total per day, combining CGST and SGST), capped at ₹5,000.

How Taxring Helps in GST Return Filing

At Taxring, we simplify the GST return filing process by offering:

- Complete GST Compliance Support: Our experts ensure your filings are timely and accurate.

- End-to-End Support: From document preparation to filing, we handle it all, reducing your workload.

- Transparent Communication: Receive regular updates on your filing status to stay informed at every step.

GST Filing Returns FAQs

Q.What if I miss a GST return deadline?

Missing a deadline incurs penalties. File as soon as possible to mitigate charges.

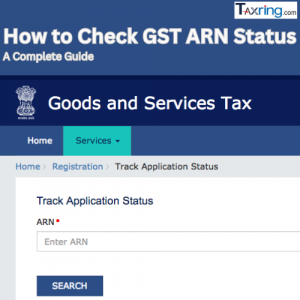

Q.How can I check my GST return filing status?

Log in to the GST portal and navigate to the 'Returns Dashboard' to view your status.

Q.Do you need a CA for GST filing?

While not mandatory, hiring a CA can help ensure accurate and timely submissions.

Q.What is the filing period for GST?

Filing periods vary; regular taxpayers usually file monthly, while composition scheme taxpayers file quarterly.

Q.Is monthly GST return mandatory?

Yes, for regular taxpayers with turnover exceeding the threshold; composition scheme taxpayers file quarterly.

Q.How do I file a zero return in GST?

Log in to the GST portal, select the return form, and indicate zero transactions for the period.

Q..can i file gst return myself?

Yes, but ensure compliance and accurate reporting to avoid penalties.

Q.What is the time limit for GST return rectification?

Errors must be rectified within the period of filing subsequent returns or within one year from the annual return's due date.

Related read also: GST Registration comprehensive guide , GST Return Filing overview