How to Check GST ARN Status: A Complete Guide

If you’re applying for GST registration in India, a critical aspect to monitor is your GST ARN status. The Application Reference Number (ARN) is a unique identifier assigned to each GST registration applicant, allowing you to track the progress of your application effectively.

This article provides a comprehensive guide on how to check your GST ARN status and understand its significance.

What is an ARN Number?

The Application Reference Number (ARN) is a 15-digit code issued to applicants upon submission of their GST registration application. This number serves as a key reference for tracking your GST ARN status, indicating whether your application is pending, under review, or has been approved.

Importance of the GST ARN Number

The GST ARN number is essential for monitoring your application’s progress. It allows you to:

- Track Application Progress: Use your ARN to check the GST registration status and stay updated on your application’s progress.

- Identify Pending Clarifications: If your GST ARN status indicates “pending for clarification,” you can quickly determine if any further action is needed.

- Verify Registration Completion: When your GST ARN status shows that your application has been approved, it signifies that your GST registration is complete, and you will receive your GSTIN (Goods and Services Tax Identification Number).

ARN Number Generation Process

Upon applying for GST registration, the ARN is generated automatically by the system after you submit your application along with the required documents. Here’s the typical process:

- Submit Your GST Application: Complete and submit the GST registration form with all necessary documents.

- ARN Assignment: The GST portal generates an ARN for your application.

- Receive ARN Notification: You will receive your ARN via email and SMS linked to your application.

This ARN is crucial for performing a GST ARN status check throughout the application process.

Documents Needed to Check GST ARN Status

Before checking your GST ARN status, ensure you have the following documents ready:

- Application Reference Number (ARN)

- PAN Card of the business entity or individual

- Acknowledgment Receipt of GST registration

- Clarification Documents (if requested)

Having these documents at hand will make the GST ARN status check process smoother.

How to Check Your GST ARN Status

You can check your GST ARN status in two ways: without logging into the GST portal and after logging in. Here’s how:

1. Check GST ARN Status Without Logging In

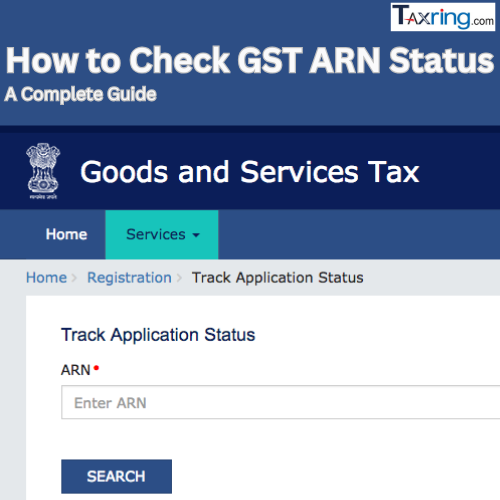

To check your status without logging in, follow these steps:

- Visit the GST Portal at www.gst.gov.in.

- Navigate to Services > Registration > Track Application Status.

- Enter your ARN number and the Captcha code.

- Click Search.

The portal will display the current status of your application.

2. Check GST ARN Status After Logging In

For a more detailed update, log in to the GST portal:

- Go to the GST Portal and log in with your credentials.

- Click on Services > Registration > Track Application Status.

- Enter your ARN number or other application reference data.

- Review the detailed status of your GST ARN, including any additional requirements or clarifications needed.

Types of GST ARN Application Status

When checking your GST ARN status, you may encounter various statuses, including:

- Pending for Processing: Your application is under review and hasn’t been processed yet.

- Pending for Clarification: Additional information or documents are needed from your end.

- Clarification Filed - Pending for Order: Your clarification has been submitted and is awaiting approval.

- Approved: Your application has been successfully processed, and your GSTIN will be issued shortly.

- Rejected: The application has been rejected due to insufficient documentation or errors.

Understanding Each GST Registration Status

Pending for Processing

Your application is currently being reviewed. Typically, this can take up to 7 days for progress.

Pending for Clarification

This status indicates that the authorities require further documents or information from you. Log in to the GST portal to submit the necessary details.

Clarification Filed - Pending for Order

After submitting your clarification, this status means it’s under review. No further action is needed unless requested again.

Approved

Your application has been approved, and your GSTIN will be issued shortly.

Rejected

This status means your application was rejected due to errors or incomplete information. You can reapply after addressing the issues.

Benefits of Monitoring Your GST ARN Status

Regularly checking your GST ARN status ensures you stay informed about your application’s progress. It helps you address any issues promptly and may expedite the approval process by ensuring timely responses to any clarifications requested by the authorities.

Key Considerations for Checking GST ARN Status

- Ensure your ARN number is accurate before entering it on the portal.

- Stay alert for updates via email or SMS regarding any clarifications needed.

- If your GST ARN status remains pending for processing for an extended period, consider contacting the GST helpdesk for assistance.

Taxring Services for GST Registration

At Taxring, we provide comprehensive support for GST registration, tracking your GST ARN status, and addressing any pending clarifications. Whether you need help with filing GST returns, resolving disputes, or applying for new GST registration, Taxring simplifies the entire process, allowing you to focus on growing your business.

An ARN number is a unique identifier provided after submitting your GST registration application, used to track the application’s status.

You can check it by visiting the GST portal, clicking on "Track Application Status," and entering the ARN number.

This status indicates that further documents or clarifications are needed from your end to process your application.

It typically takes 7-10 working days to receive a GST number, assuming no clarifications are required.

Yes, you can check it without logging in by using the Track Application Status option on the GST portal.

If rejected, you will need to reapply for GST registration, addressing the reasons for rejection.

Log in to the GST portal, navigate to Track Application Status, and submit the required documents for clarification.

It means your clarification has been submitted and is awaiting final order from the GST authorities.

No, you need to use the GST portal or GST mobile app to track the ARN status.

No, the ARN is essential for tracking the status of your GST registration application.