How To File ITR Online: A Step-by-Step Guide to E-filing Income Tax Returns for FY 2023-24 (AY 2024-25)

File Your Income Tax Return with Ease

An Income Tax Return (ITR) is a vital document that records your financial transactions, including income, expenses, deductions, investments, and taxes. As per the Income-tax Act of 1961, filing ITR is mandatory in various scenarios. However, even if you don't meet the income threshold, filing ITR can be beneficial for carrying forward losses, claiming refunds, and accessing loans, visas, and insurance.

E-filing is a convenient and secure way to submit your ITR online through the income tax portal. With your PAN-based login credentials, you can access a range of features that simplify the tax filing process. At Taxring Private Limited, we can guide you through the process and ensure compliance with all regulatory requirements."

Step-by-Step On How To E-file ITR On The Income Tax Portal

Step One: Login.

Visit the official Income Tax e-filing website and select 'Login'.

Enter your PAN into the User ID field.

Click 'Continue'.

Check the security message in the checkbox.

Enter your password and click 'Continue'.

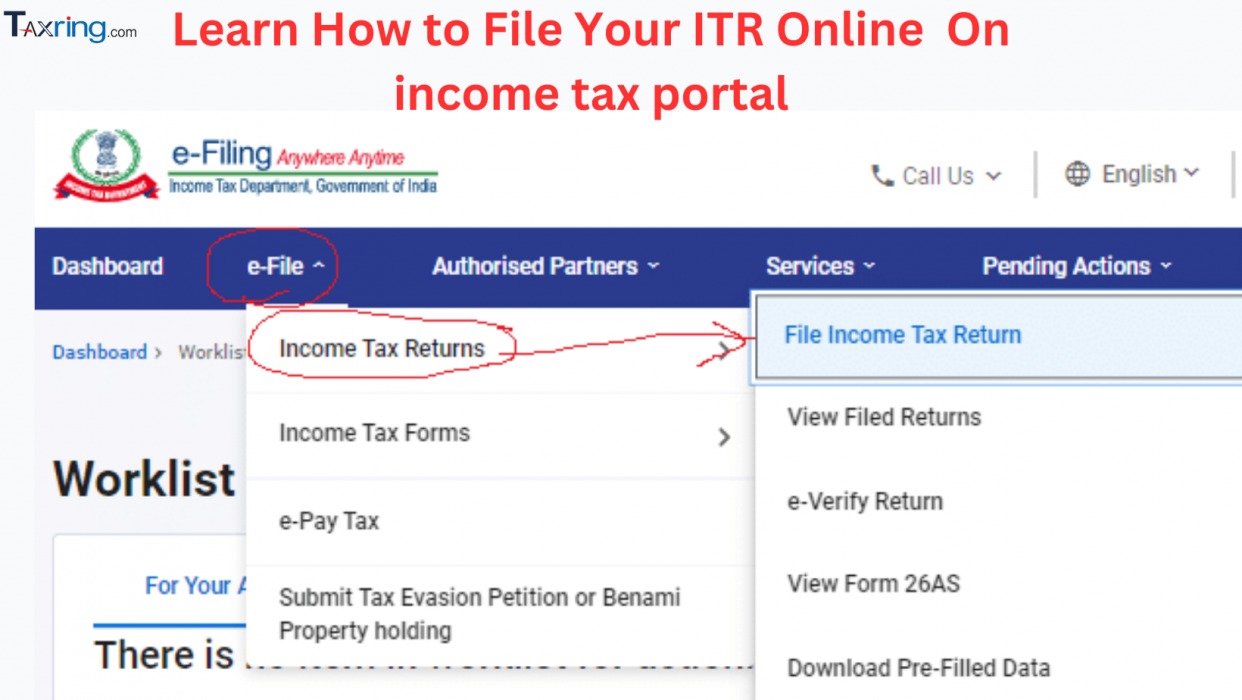

Step 2: Go To ‘File Income Tax Return

Click the 'e-File' tab > 'Income Tax Returns' -> 'File Income Tax Return'

Step 3: Choose the Right 'Assessment Year'

If you are filing for fiscal year 2023-24, select 'Assessment Year' as 'AY 2024-25'. Similarly, if you are filing for the fiscal year 2022-23, pick 'AY 2023-24' and 'Online' as the filing mode. Select the relevant filing type, either original or revised.

Step 4: Select the Status.

Select the appropriate filing status: Individual, HUF, or Others.

Select 'Individual' and 'Continue' to file for individuals such as yourself and me.

Step 5: Select the ITR Type.

Now, choose the ITR type. Before filing returns, the taxpayer must determine which ITR form they need to complete. There are seven ITR forms available, with ITRs 1 through 4 applicable to individuals and HUFs. Individuals and HUFs, for example, who do not have business or professional income but do have capital gains can claim ITR 2. Find out which ITR you should file.

Step 6: Declare Your Filing Purpose

Specify your reason for filing an income tax return:

- Taxable income surpasses the basic exemption threshold

- Mandatory filing requirement (applicable to designated individuals)

Select the relevant option to progress with your ITR submission.

Step 7: Verify and Confirm Pre-Populated Details

Your personal information, including PAN, Aadhaar, name, date of birth, contact details, and bank account information, will be auto-filled. Carefully review and validate these details to ensure accuracy. If you haven't already, provide your bank account information, and ensure it's pre-validated. As you progress, disclose all relevant income, exemptions, and deductions. Note that most of your information will be pre-filled based on data from your employer, bank, and other sources. Thoroughly review the summary of your returns, confirm the details, and pay any outstanding taxes."

Step 8: E-Verify ITR.

The final and most important step is to confirm that your return is within the time restriction (30 days). Failure to verify your return is the same as not filing it at all. You can e-verify your return using many means, including Aadhaar OTP, electronic verification code (EVC), Net Banking, or submitting a physical copy of ITR-V to CPC, Bengaluru.

Documents Required to File ITR

To e-file their ITR, they must provide the following documents and information:

Required documents include PAN, Aadhaar, bank statements, and Form 16.

Documents may include donation receipts, stock trading statements, and insurance policy payments for life and health.

Linking bank account information to PAN and using an Aadhaar-registered cellphone number for e-verification on returns.

Interest certificates from banks

However, you can e-file your ITR with Taxring by simply entering your PAN. We will auto-fill the majority of your details from the Income Tax Department, such as salary income, TDS, deduction details, and so on. Here's a full tutorial to e-filing your ITR on Taxring

Related Articles: