How to Revised Income Tax Return: Section 139(5)

Budget 2024 Update

FM Nirmala Sitharaman has made two announcements for those opting for the new tax regime.

First, the standard deduction for salaried employees is proposed to be increased from Rs 50,000/- to Rs 75,000/-. Similarly, deduction on family pension for pensioners is proposed to be enhanced from Rs 15,000/- to Rs 25,000/-.

Second, in the new tax regime, the tax rate structure is proposed to be revised, as follows:

0-3 lakh rupees - NIL tax

3-7 lakh rupees - 5% tax

7-10 lakh rupees - 10% tax

10-12 lakh rupees - 15% tax

12-15 lakh rupees - 20% tax

Above 15 lakh rupees - 30% tax

As a result of these changes, a salaried employee in the new tax regime stands to save up to Rs 17,500/- in income tax.

Filing your Income Tax Return (ITR) correctly is critical for a number of reasons. Inaccuracies might cause delays in processing, requests for additional tax payments, or penalties. Underreporting income might potentially lead to legal implications. However, the Income Tax Department includes provisions to remediate errors and assure proper tax filing procedures. It is critical to take advantage of this provision, Section 139(5) of the Income Tax Act, Revised Return, to ensure compliance and prevent avoidable problems.

This allows taxpayers to correct errors or add missing information by filing an amended return.

What is a Revised Income Tax Return under Section 139 (5)?What is a Revised Income Tax Return under Section 139 (5)?

A Revised Return under Section 139(5) of the Income Tax Act allows taxpayers to correct mistakes or omissions in their original tax return. Since income tax returns can be complex and prone to errors, Section 139(5) offers a way to address discrepancies that arise from unintentional mistakes or missed information. This can be done even after receiving a tax notice. If you discover an error or omission in your original or delayed return filed under Section 139(1) or 139(4), you can submit a Revised Return to fix it.

Possible Reasons to File a Revised Return

Taxpayers have the opportunity to file a Revised Income Tax Return (ITR) to correct mistakes or oversights in their initial filing, as per Section 139(5) of the Income Tax Act of 1961. This provision allows for the adjustment of inaccuracies or missing details in the original return. Typical reasons for submitting an amended return include:

Why You Might Need to File a Revised Income Tax Return (ITR)

1. Error Correction: If you discover mistakes or omissions in your original ITR—such as incorrect income reporting, deductions, or other details—you can file a Revised Return. This lets you update your information and ensure your tax records are accurate.

2.Missed Reporting: If you accidentally left out income sources, deductions, or exemptions in your initial return, a Revised Return allows you to include these missing details, ensuring your tax assessment reflects all relevant information.

3.Tax Calculation Adjustments: Should there be changes in tax laws, rules, or rates that affect your liability after you’ve filed, a Revised Return lets you adjust your tax calculation to align with the new regulations.

4.Other Situations:

- Change in Residential Status: If your residency status changes from resident to non-resident or vice versa after filing.

- Correction of Assessment: Addressing issues or discrepancies identified by the tax authorities during their assessment.

- Claiming a Refund:If you realize you’ve overpaid and are eligible for a refund after the original filing.

The Income Tax Act allows for the filing of a revised income tax return in these and other instances where the taxpayer has made a mistake. A revised income tax return is one in which the taxpayer corrects errors and resubmits his tax return.

What is the Revised Return Due Date Under the Income Tax Act?

Now You must be wondering about the revised return time limit. The updated return under Section 139(5) of the Income Tax Act must be filed by December 31 of the assessment year or before the assessment is completed, whichever is earlier. Even if the tax department has already processed the initial return, it is still possible to file. There is no limit to how many times the tax return can be updated.

The deadline for the updated return for the fiscal year 2023-24 (assessment year 2024-25) is on or before December 31, 2024, assuming that the assessment of the original return has not been completed by then.

Who can File a Revised Income Tax Return Under Section 139(5)?

Any taxpayer who submitted an original income tax return under Section 139(1) of the Income Tax Act of 1961 may file a revised income tax return under Section 139(5) of the Income Tax Act. This applies to:

- Individuals

- Businesses (including businesses, partnerships, and Hindu Undivided Families).

If you filed an original or a belated return (filed after the due date but before the assessment is completed), you can update it under Section 139(5) of the Income Tax Act to correct any errors or omissions.

Is there a penalty for filing a revised Income Tax Return (ITR) after July 31?

Your tax return will be recognized as amended only if it was filed before the due date, which is July 31, 2024, and e-verified within 30 days of filing. If the return is not filed by the due date, it will be considered a belated tax return, and the taxpayer would be charged late costs under Section 234F. Belated returns can also be filed by December 31, 2024, with a penalty of Rs 1,000 (for income between Rs 2.5 lakh and Rs 5 lakh) or Rs 5,000 (for income beyond Rs 5 lakh).

What to Expect When Filing a Revised Return

Filing a revised return is generally straightforward, especially for minor updates like correcting bank account details or personal information. In such cases, you typically won’t face any significant consequences.

However, if your revised return includes substantial changes, such as undeclared income or significant corrections, the tax authorities may review your updated filing more closely.

Important Note: If the revised return reveals higher taxable income, you might owe additional taxes, potentially along with interest.

Essential Tips for Filing a Revised Income Tax Return

When updating your income tax return, keep these important considerations in mind:

1.Complete Replacement:A revised return supersedes your original filing entirely. Once submitted, it stands as your final return for the year.

2.Refunds and Revisions:Even if you’ve already received a refund, you can file a revised return as long as it’s within the allowable time frame.

3.Form Corrections:Use a revised return to correct any errors or update details on your e-filing form.

4.Unlimited Revisions: There’s no cap on the number of times you can file a revised return. Feel free to make necessary corrections as often as needed.

5.Post-Assessment Limitations:You cannot file a revised return once your assessment has been completed by the tax authorities under Section 143(3).

6. No Penalties: Filing a revised return won’t incur any penalties. Mistakes happen, so take advantage of this opportunity to correct any errors without fear of additional charges.

For a smooth revision process, you can use the Taxring platform or enlist our skilled online CAs. Our experts are ready to ensure your income tax filing is accurate and hassle-free.Book your eCA now

How to file Revised Return for AY 2024-25?

Taxpayers can modify their returns by completing these steps:

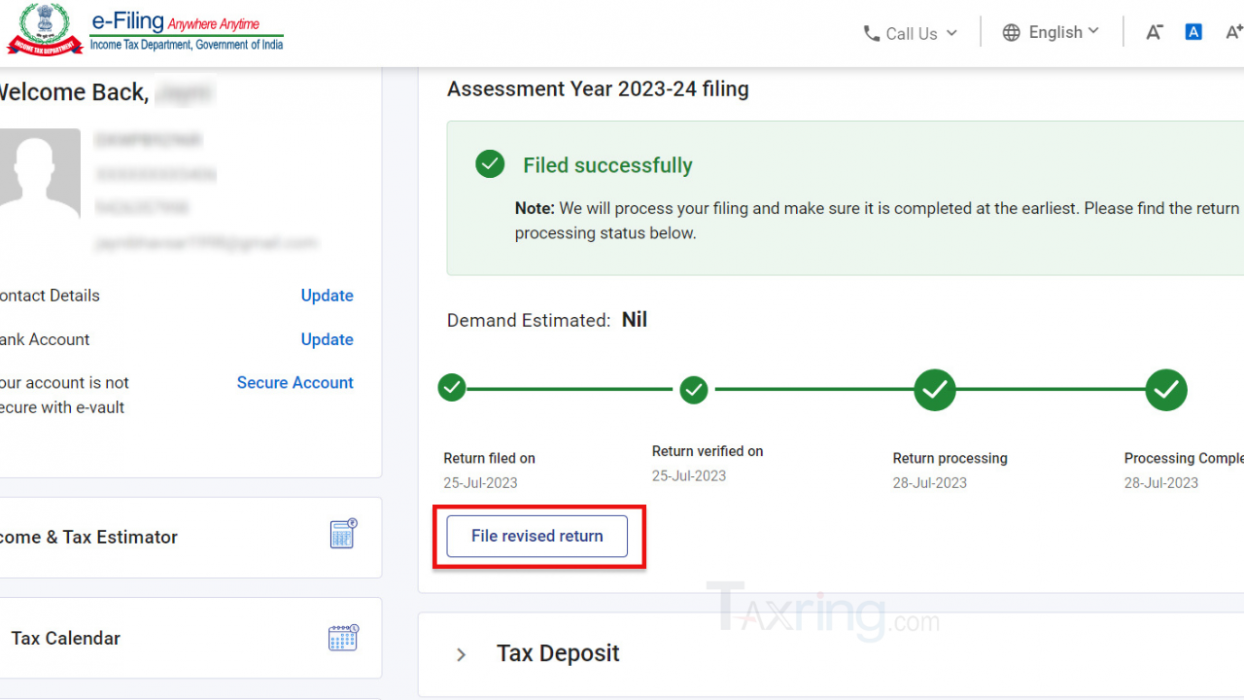

Step1.Log into the e-filing portal.

Log in to the e-filing portal, then select e-file > Income Tax Return > File Income Tax Return.

Or, click on the file revised return option from the dashboard.

Step 2.Select the appropriate details.

Select the appropriate assessment year, mode of filing, filing type (updated return), audit option, and ITR type.

Step 3.Attach JSON

Attach the JSON file to upload the return and then proceed for verification

Step 4. E-verify your return.

To submit the return, you must complete e-verification within 30 days of submission.

Step5. Submit your return.

Once the e-verification is completed, the success message and transaction ID will be displayed.

Revising Your Income Tax Return: Expert FAQs

Q: Can I submit a revised return after my ITR has been processed?

Absolutely! You can file a revised return even if your original Income Tax Return (ITR) has been processed by the Centralized Processing Center (CPC). If you spot any discrepancies, simply submit a rectification request through the e-Filing portal. If the CPC hasn’t yet processed your ITR, you can directly file a revised return. Just be sure to do so before the deadline.

Q: How long does it take to process a revised return?

Revised returns typically follow the same processing timeline as original returns, which is about 10 days on average, post e-verification.

Q: Can I file a revised return right away?

Yes, the Income Tax Act allows you to file a revised return as soon as you identify any errors or omissions in your original or belated return.

Q: What’s the procedure for correcting a submitted income tax return?

To correct your tax return, you need to file a revised return under Section 139(5) of the Income Tax Act.

Q: When is the deadline to file a revised return for AY 2024-2025?

You can file a revised return for the assessment year 2024-2025 by December 31, 2024, or before the original return’s assessment is completed, whichever comes first. To ensure timely and accurate filing, consider consulting a tax expert.

Q: What if my revised return contains mistakes?

If your revised return has errors, you can file another revised return within the allowable time frame to correct them.

Q: Is e-verification required for a revised ITR?

Yes, just like the original return, your revised ITR must be e-verified within 30 days to complete the filing process. Ensure that both the original and revised returns are e-verified within the prescribed time limits.

Q: How many times can I revise my return?

You can revise your return as often as necessary. However, it’s best to consolidate all corrections into a single revised return whenever possible.

Q: What’s the final date to file a revised return?

Under Section 139(5) of the Income Tax Act, you can file a revised return by December 31 of the relevant assessment year, or before the completion of the assessment, whichever comes first.

Q: How do I correct a defective income tax return?

You can address a defective return by filing a revised return or responding to any notice issued regarding the defect.

Q: Who is eligible to file a revised return?

Anyone who has filed the original tax return is eligible to file a revised return. This includes belated returns.

Q: Does filing a revised return replace the original one?

Yes, a revised return completely supersedes the original return. Once a revised return is filed, it is considered the final submission for that assessment period.

Q: Is there a penalty for submitting a revised return?

No, there is no penalty for filing a revised return.

Q: How can I submit a revised income tax return?

Filing a revised return is straightforward. For detailed instructions, refer to our guide. If you need further assistance, Tax2Win is available to help—click here for support.

Q: Can I cancel a revised return once filed?

Cancellation of a filed return isn’t possible. However, if you’ve made errors in a revised return, you can submit another revised return within the allowed time frame under Section 139(5). Alternatively, you can opt not to e-verify the incorrect return, which will prevent it from being processed.

Q: Can a revised return be filed for a belated return submitted after the due date?

Yes, a revised return can be filed for a belated return. For the fiscal year 2023-24, you have until December 31, 2024, to make revisions.

Q: Is it possible to file a revised return after receiving an intimation under Section 143(1)?

Yes, even after receiving an intimation under Section 143(1), you can still file a revised return. This intimation is typically sent to taxpayers once their ITR has been processed.

Q: Should I file a revised ITR if it results in a higher tax liability?

Experts advise that you should report any unreported income or gains when filing a revised ITR, even if it increases your tax liability. This helps avoid severe penalties, notices, or legal issues for failing to disclose income.