How to track Your Status of Pan Card Online

A Permanent Account Number (PAN) is a unique 10-character alphanumeric identifier required for all financial transactions and tax filings in India. To ensure timely delivery, follow the status of your new PAN Card application or request adjustments to an existing one.

You can check the status of your PAN card online at the NSDL and UTIITSL websites by entering your acknowledgment number.

PAN cards are normally delivered within 15 to 20 business days of application submission.

Check Status of Pan Card

A Permanent Account Number (PAN) is a unique 10-character alphanumeric identifier required for all financial transactions and tax filings in India. To ensure timely delivery, follow the status of your new PAN Card application or request adjustments to an existing one.

You can check the status of your PAN card online using your acknowledgement number at the NSDL and UTIITSL websites.

Status Track search for PAN/TAN

| The PAN card is typically delivered within 15 to 20 business days from the date of application submission. |

Track PAN Application Status

You can monitor the progress of your PAN card application status through the official NSDL or UTIITSL websites. This process requires a unique 15-digit Acknowledgement Number, which is provided once you submit your application.

| The PAN acknowledgement number is a unique 15-digit code given to you upon submitting your PAN card application. It is used to track the status of your application online via the NSDL or UTIITSL websites. |

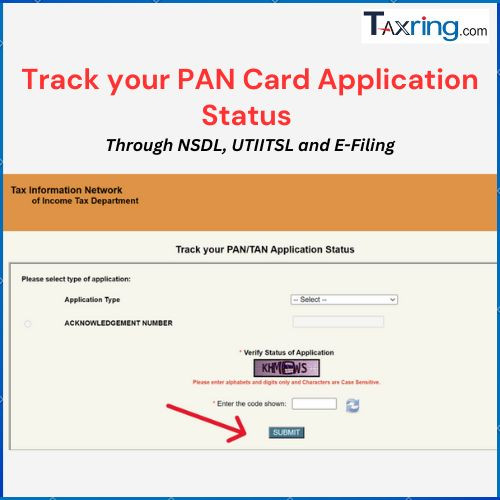

Via NSDL Website (Protean PAN Services)

Tracking the status of your PAN card application is quick and easy through the TIN NSDL portal. This online service, managed by the Tax Information Network (TIN) and NSDL, allows applicants to monitor the progress of their PAN card applications effortlessly.

- Visit the NSDL Website:

- Navigate to the official NSDL – https://www.protean-tinpan.com/ website.

- Access Online PAN Services:

- Scroll and navigate to the PAN Services links on the homepage, and click on the Know your Status link.

- Enter Details:

- Provide your 15-digit acknowledgement number and the captcha code displayed on the screen.

- Submit:

- Click the “Submit” button to view your PAN card application status.

By following these steps, you can easily track the status of your PAN card application and stay updated on its progress.

Via UTIITSL Website

Tracking your PAN card application status through UTIITSL is easy and quick. UTI Infrastructure Technology And Services Limited (UTIITSL) provides an online portal where you can check the progress of your PAN card application.

- Visit the UTIITSL Website:

Open the official UTIITSL – https://www.utiitsl.com/ website. - Track PAN Card:

Click on “Track PAN Card” to proceed.

- Choose Tracking Method:

Select either “PAN Number” or “Application Coupon Number” for tracking. - Enter Required Information:

- If using the PAN number, enter your 10-digit PAN number.

- If using the application coupon number, input the relevant number.

- For individuals, provide your date of birth. For entities, supply the date of incorporation, agreement, or partnership.

- Captcha and Submission:

Enter the captcha code and click “Submit” to see the status.

Check Instant e-PAN Card Status

For those who have applied for an Instant e-PAN using their Aadhaar number, tracking the status is straightforward. Here’s how:

- Visit the Income Tax e-Filing Website:

Open the official Income Tax e-filing portal – https://www.incometax.gov.in/iec/foportal/. - Access Instant e-PAN Services:

Click on “Instant e-PAN” and proceed to “Check Status/Download PAN.”

- Enter Aadhaar Number:

Input your Aadhaar number and complete the OTP verification process. - View Status:

Once verified, your e-PAN card status will be displayed.

| Instant e-PAN is a quick, paperless service from the Income Tax Department of India, allowing you to get a PAN card instantly using your Aadhaar number. It’s perfect for urgent needs, requiring only a valid Aadhaar and registered mobile number. |

PAN Card Status Without Acknowledgement Number

PAN card status is updated in real time, reflecting various stages like ‘Application Received,’ ‘Under Process,’ ‘Card Dispatched,’ and ‘Delivered.’

You can track your PAN card status without the acknowledgement number in three ways:

Through Name and Date of Birth on NSDL Website

- Visit NSDL Website: Go to NSDL PAN Status Track page.

- Enter Your Name: Provide your first name, middle name, and last name as it appears on your PAN application. (For non-individual applicants, enter the name in the Last Name/Surname section).

- Enter Date of Birth: Input the date of birth or date of incorporation/agreement/partnership or trust deed/formation of a body of individuals/association of persons.

- Submit: Click the “Submit” button to check status.

Through Coupon Number on UTIITSL Portal

- Visit UTIITSL Website: Go to the UTIITSL portal.

- Track PAN Card: Click on “Track PAN Card.”

- Enter Coupon Number: Provide your application coupon number.

- Enter Date of Birth: If you applied as an individual, enter your date of birth. For entities, provide the date of incorporation or agreement.

- Submit: Enter the captcha code and click “Submit” to see the status.

Through PAN Number on UTIITSL Portal

- Visit UTIITSL Website: Go to the UTIITSL portal.

- Track PAN Card: Click on “Track PAN Card.”

- Enter PAN Number: Provide your 10-digit PAN number.

- Enter Date of Birth: If you applied as an individual, enter your date of birth. For entities, provide the date of incorporation or agreement.

- Submit: Enter the captcha code and click “Submit” to see your the status.

Additional Methods for Tracking PAN Status

- Customer Care: Call the TIN customer care at 020-27218080 and provide your acknowledgement number to get an update on your PAN status.

- SMS Service: Send an SMS with your acknowledgement number to 57575 for an immediate update on your PAN status.

| Applicants receive notifications about the PAN card status through SMS or email if provided during the application process, giving real-time updates without having to visit the website. |

PAN Card Status Types

Understanding status types helps you track your application and resolve issues quickly. Below are the common status types and their meanings:

| Status Type | Meaning |

|---|---|

| Application Received | Your PAN application has been successfully submitted and acknowledged. |

| Under Process | The application is being processed, and documents are under review. |

| Objection Marked | There’s an issue with your application (e.g., missing or incorrect documents), requiring corrective action. |

| Awaiting Dispatch | The PAN card is ready and awaiting dispatch after completion of all processes. |

| Dispatched | Your PAN card has been dispatched and is en route to your address. |

| Delivered | Your PAN card has been successfully delivered to the provided address. |

| Application Rejected | The application has been rejected due to errors or discrepancies in the submitted documents. |

| Document Pending | Processing is delayed due to missing documents that need to be submitted. |

| If the status shows ‘Dispatched’ but you haven’t received the card, track the delivery through the provided courier tracking details. If the delivery is delayed, raise a complaint with NSDL/UTIITSL for re-dispatch. |

Helpline

If you have any questions or problems with your PAN card, you can contact to their helpline number.

| Service | Contact Numbers | Timings | |

|---|---|---|---|

| UTIITSL Helpline | +91 33 40802999, 033 40802999 | 9:00 AM to 8:00 PM (Open all days) | utiitsl.gsd@utiitsl.com |

| NSDL Helpline | (020) 272 18080 |

|

Related article: How to download Pan card application form pdf? , Apply for new pan card

FAQ

Q1. Can we apply for a PAN card online?

A: Yes, the PAN card application form can be filled and submitted online click here

Q2. How to get a PAN card online?

A: To get a PAN card online, visit the NSDL or UTIITSL portal, fill in Form 49A, upload the required documents, pay the fee, and submit the form.

Q3. What documents are needed for a PAN card application?

A: For Indian residents, documents like an Aadhaar card (for both identity and address proof) and a birth certificate are commonly required.

Q4. How to apply for a PAN card online step by step?

A: Visit the NSDL website, fill in Form 49A, attach necessary documents, make the payment, and submit the application.

Q5. Can I apply for a PAN card with my Aadhaar card?

A:Yes, you can easily apply for a PAN card online using your Aadhaar card as both identity and address proof.

Q6. How to correct errors on my PAN card?

A: To correct errors, submit a PAN card rectification form along with the correct details and supporting documents through the NSDL or UTIITSL website.

Q7. How long does it take to receive a PAN card?

A: Once you have successfully submitted your PAN card application, it generally takes 10-15 business days to receive the card.

Q8. Can I track my PAN card application status?

A:Yes, you can track your PAN card application status by entering your acknowledgment number on the NSDL or UTIITSL website.

Q9. Is it mandatory to link PAN with Aadhaar?

A: Yes, as per government regulations, linking your PAN card with Aadhaar is mandatory to file income tax returns.

Q10. Can a minor apply for a PAN card?

A: Yes, minors can have a PAN card, and parents or guardians can apply on their behalf.

Q11. What should I do if my PAN card is delayed?

A: If your PAN card is delayed beyond the expected time, check your application status online. You may also contact customer support for further assistance.

Q12. Can I get a duplicate PAN card if mine is lost?

A: Yes, you can apply for a duplicate PAN card online through the NSDL or UTIITSL website by submitting the required details and documents.

Q13. What is the fee for applying for a PAN card online?

A: The fee for applying for a PAN card online varies based on whether you are a citizen of India or a foreign national. It typically ranges from ₹93 to ₹1,200.

Q14. Can I change the name on my PAN card?

A: Yes, you can change your name on the PAN card by submitting a PAN card rectification form along with the necessary documents to support the name change.

Q15. How do I update my address on my PAN card?

A: To update your address, fill out the PAN card rectification form online, provide the new address details, and upload supporting documents as required.