Must-Have Documents for Smooth Income Tax Return (ITR) Filing in India FY 2023-24 (AY 2024-25)

Income Tax is a levy imposed on individuals and entities based on their earnings and profits. For the financial year 2023-24 (Assessment Year 2024-25), the deadline to file income tax returns is 31st July 2024.

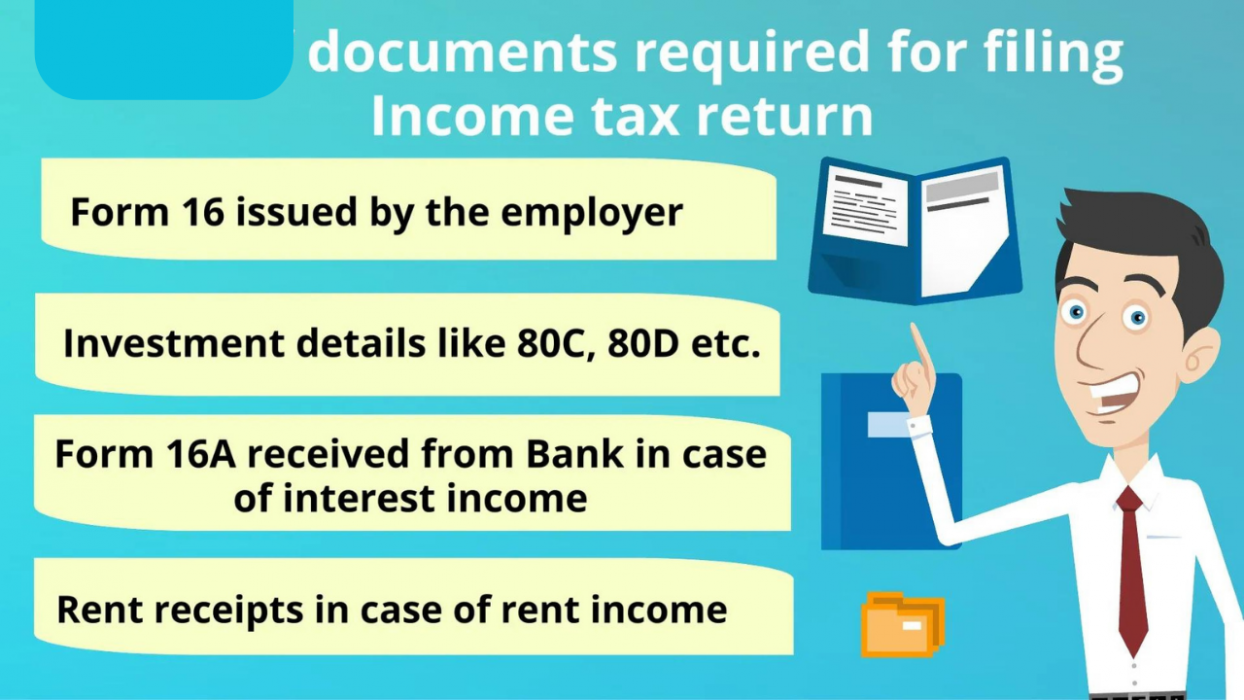

When filing your income tax return (ITR), certain documents are crucial as evidence of your earnings for that financial year. These documents must be submitted to the Income Tax Department.

The specific documents required and the filing process can vary depending on the source of income—whether from business profits, investments, salary, etc. Organizing these documents beforehand can streamline the ITR filing process and ensure compliance with tax regulations.

To help you file your Income Tax Return (ITR) for FY 2023-24 (AY 2024-25), here is a checklist of essential documents you should gather before you start filing Your Return

What are the Important Documents Required for Filing ITR?

Income Tax Return (ITR) documents vary based on the taxpayer's income sources. However, certain documents are mandatory for all taxpayers, regardless of their income streams. Here's a list of essential ITR documents required for filing FY 2023-24 (AY 2024-25):

1. PAN Card:

The PAN (Permanent Account Number) is essential for filing income tax returns. It is also used for TDS deductions and should be linked to your bank account for direct income tax refunds, if applicable. You can find your PAN number on your PAN card, Form 26AS, Form 16, Form 12BB, etc. Recently, the government has allowed taxpayers to file ITR using their Aadhaar number instead of PAN.

2. Aadhaar Card:

As per Section 139AA of the Income Tax Act, individuals must provide their Aadhaar card details when filing returns. If you have applied for Aadhaar but haven't received it yet, you can use the enrolment ID in your IT returns. Linking PAN and Aadhaar facilitates online verification of your income tax return through OTP. The deadline for income tax return filing is 31st July every year.

Form 16

Form 16 summarizes an employee's salary and deducted TDS. Part A includes employer's tax details and PAN/TAN info, while Part B outlines salary breakup and allowances. Employers issue Form 16, crucial for salaried individuals filing ITR. Alternatives exist for filing ITR without Form 16, supported by online filing assistance.

Other Forms - 16A, 16B, 16C:

Form 16A applies to TDS on non-salary incomes such as deposits. Form 16B concerns property sale TDS, issued by buyers. Form 16C, related to 5% rent TDS under section 194IB, is issued promptly after Form 26QC by individuals or HUFs. Banks and contractors handle Form 16A issuance.

Bank Account Details:

ITR requires disclosure of all active bank accounts: bank name, account number, IFSC. Designate one for electronic tax refunds. Obtain details from passbooks, statements, or net banking. Accuracy is vital for income disclosure and monitoring by the Income Tax Department.

Bank Statement/Passbook:

Bank statements detail interest earned on savings accounts and fixed deposits annually, crucial for income tax return (ITR) filings.

Form 26AS and AIS/TIS:

Form 26AS acts as an annual tax statement, akin to a tax passbook, recording all taxes deposited against your PAN. This includes TDS deductions by banks, employers, and other entities. It's essential to verify that all deductions match those in Form 26AS to claim proper tax credits. Access Form 26AS through the Income Tax India e-filing website. The Annual Information Statement (AIS) app consolidates TDS, TCS, and interest details for ease of access.

Home Loan Statement:

Providing a breakdown of principal and interest payments, essential for substantiating claims while filing ITR, particularly if you've acquired a home loan from financial institutions.

Tax Saving Instruments:

Documents related to tax-saving schemes like tax-saving FDs, ELSS, and investment receipts are necessary for accurate tax deduction calculations. Simplify the process with an 80C calculator for precise deductions.

Capital Gains Details:

For gains or losses from selling securities, shares, or property, maintain records such as broker statements or property sale deeds. Seek expert advice for assistance with capital gains ITR filings.

Rental Income:

Report income from property rentals while filing ITR. Retain receipts from landlords for future verification, though these aren't required with your ITR submission.

Foreign Income:

Documents pertaining to income earned abroad are vital for claiming tax credits and Double Taxation Avoidance Agreements (DTAA). Coordinate with your tax consultant to organize relevant documents.

Dividend Income:

Include earnings from dividends on shares or mutual funds in your income tax return. Obtain details from broker statements or Demat account summaries.

Interest Certificate:

Maintain interest certificates for home loans or similar benefits to substantiate claims for tax benefits.

Failure to submit correct documents can lead to penalties of up to 200% for incomplete information in your ITR. Consult experts to ensure you're submitting the appropriate documents for your situation.

What Documents are Required to Claim a Deduction u/s 80C to 80U of Income Tax hWile filing ITR?

Here are essential documents that taxpayers should gather to streamline the income tax filing process and maximize deductions:

Home Loan Statement: Obtained from the bank to claim deductions under section 80C for principal repayment and section 24(b) for interest payment on self-occupied or let-out property.

School Fee Receipt: Essential for claiming deduction under section 80C for tuition fees paid for up to two children.

Contribution to PPF, Life Insurance Premium Receipts: Documents verifying investments in tax-saving instruments eligible for deduction under section 80C, such as Public Provident Fund (PPF), Life Insurance Corporation (LIC) policies, and 5-year tax-saving Fixed Deposits (FDs).

Investment in NPS:Proof of investment for additional tax benefits under section 80CCD and 80CCD(1B) beyond the 80C limit.

Donation Receipts:Required for deductions under section 80G for donations made to eligible institutions.

Medical Insurance Details:Receipts confirming premiums paid for medical insurance policies eligible for deduction under section 80D.

Education Loan Interest Certificate:Evidence of interest paid on education loans for deduction under section 80E.

Receipts of Other Investments: Any other investment receipts that qualify for deductions or exemptions should also be collected.

Ensuring these documents are organized and ready ensures accurate filing of Income Tax Returns (ITR) and maximizes eligible deductions, minimizing last-minute complications.

What Documents are Required for Capital Gain Income?

Here are the essential documents required for reporting Capital Gain Income:

1.Property/Gold/Silver Sold: - Sale and purchase agreements/deeds

- Calculation details including purchase price, sale price, cost of improvements, transfer expenses

- Registration details

2. Equity Shares Sold: - Capital gain statements provided by the broker

3.Mutual Funds Sold:

- Capital Gain Statement issued by the Mutual Fund

Having these documents organized ensures accurate reporting and calculation of capital gains for tax purposes.

What Documents are Required for Income from House Property?

To accurately disclose income from house property, ensure you have the following details:

- Property address

- Co-owners' information

- Rental agreement (if applicable)

- Ownership documents

- Loan interest certificate

- Pre-construction interest details

- Municipal tax receipts

- Rental income particulars

What are the Documents Needed by a Businessman or Professional While Filing ITR?

When filing Income Tax Returns (ITR), the documentation requirements vary based on your business or professional status:

1. For Businessmen opting for Presumptive Scheme (Sec 44AD) or Professionals under Sec 44ADA

- You'll need:

- Gross Turnover/Receipts

- Gross Profit

- Additional details such as Sundry Debtors, Sundry Creditors, Stock in Trade, and end-of-year cash balance.

- It's crucial to reconcile your 26AS statement to ensure that all TDS deductions under your business are accurately reflected.

2. For Businesses not opting for Presumptive Taxation

- If your total turnover/sales exceed Rs. 1 crore during the financial year (updated to Rs. 10 crores from FY 2021-22), your accounts must be audited under section 44AB.

- Similarly, certain professionals (e.g., Chartered Accountants, Doctors, Lawyers) with receipts exceeding Rs. 50 lakhs also require audited accounts.

- Proper maintenance of all books of accounts is mandatory in these cases.

Filing ITR can be complex, especially with income from multiple sources, potentially leading to missed deductions and reduced refunds. Consulting tax professionals like eCA can streamline this process and ensure a rewarding tax filing experience.

Do I Need to Attach the Document with the Income Tax Return?

You do not need to attach any documents while filing your Income Tax Return (ITR) as it is a paperless process. However, it's prudent to safely retain documents related to income and tax deductions for 7 years. This ensures readiness in case your file undergoes detailed scrutiny by the income tax department.

The ITR filing season for FY 23-24 is underway, with online efiling already available for individuals. It's advisable to file your ITR promptly to facilitate smooth processing and avoid last-minute delays. Opt for a CA-assisted ITR filing service for convenience and accuracy.

Frequently Asked Questions

Here are optimized responses to each of your questions regarding filing Income Tax Returns (ITR):

1. Do I need a PAN card to file income tax returns now?

As per the latest provision effective from the financial year 2021-22, income tax returns can be filed using either PAN or Aadhar numbers interchangeably.

2.Can I file ITR without Form 16?

Formerly essential for salaried employees, Form 16 is no longer mandatory for filing ITR. Several alternative documents can serve as references. Services like Tax2win facilitate ITR filing even without Form 16, requiring only basic income and earnings details.

3.Is there a need to provide any document claiming section 80DD in ITR?

Submission of a disability or severe disability certificate is necessary only if requested by the Income Tax Department during scrutiny. It is not required at the time of filing returns.

4. Is there a need to produce documents when filing returns?

Documents are not required during the filing process. They are only necessary if the return is selected for scrutiny, at which point they can be uploaded on the Income Tax Portal under the e-proceedings tab.

5. Which documents are needed to file ITR for agricultural income?

No documents are typically required for filing returns on agricultural income. Exempt agricultural income details should be provided in Schedule EI (Exempt Income) of the ITR form if applicable.

6. Is a bank statement required for ITR?

While filing ITR, you only need to provide specific bank details including account number, IFSC code, and name of the bank. A bank statement may be necessary in cases where details like interest income or other credited incomes need verification.

7.What documents are required for filing a revised return?

When filing a revised return, you will need the documents used for the original return. Additionally, include documents related to the corrections being made. The acknowledgment number from the original ITR is mandatory for filing a revised return.

These responses streamline the information while addressing each query effectively.

Related Articles: