TDS Payment Online:Due Dates for TDS Return FY 2024-25

One of the most significant compliance obligations for Indian enterprises and people is Tax Deducted at Source (TDS). In addition to causing several issues with the efficient financial operation of businesses and people, late payment or filing of TDS can occasionally lead to legal issues. We have covered everything there is to know about the FY 2024–2025 TDS payment online deadlines, late filing fines, and more in one post.

Forms for Filing TDS Returns

When filing TDS returns, different forms are required depending on the type of transaction. Here’s a simple breakdown of the forms you’ll need:

- Form 24Q: This form is used for the quarterly statement of TDS on salaries. It’s essential for employers to report tax deductions from employee salaries.

- Form 27Q: Use this form to report TDS on payments made to non-residents, such as interest, dividends, and other sums payable to foreign entities or individuals (not being companies).

- Form 26Q: This form is for reporting TDS in other cases, such as professional fees, interest payments, and more.

- Challan-cum-Statement Forms:

- Form 26QB: For TDS under Section 194-IA (sale of property).

- Form 26QC: For TDS under Section 194-IB (lease payments).

- Form 26QD: For TDS under Section 194M (payments to contractors). These statements must be submitted within 30 days from the end of the month in which TDS was deducted.

Sure! Here’s a more detailed version of the content on TDS payment due dates, penalties, and related aspects, focusing on clarity and user engagement:

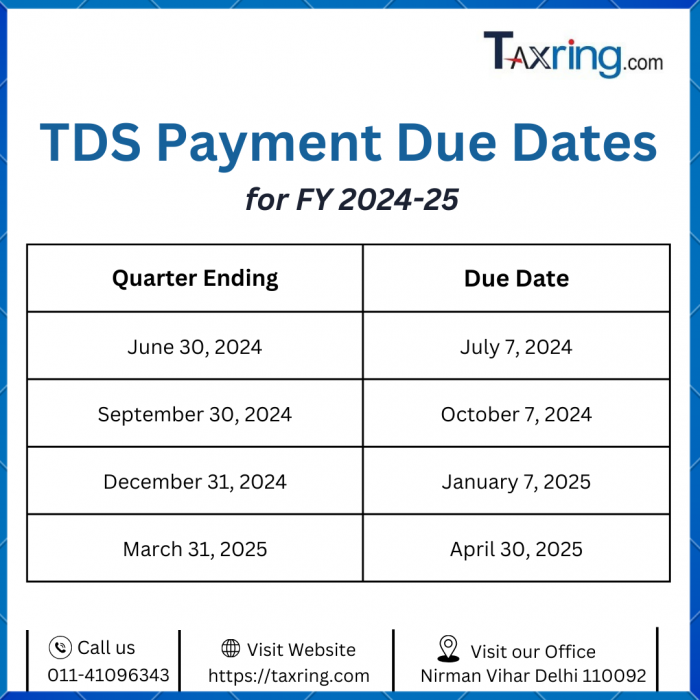

TDS Payment Due Dates for FY 2024-25

Understanding the due dates for TDS payments and returns is essential for compliance and avoiding penalties. For the financial year 2024-25, here’s what you need to know:

- Government Deductors:

- TDS must be deposited on the same day it is deducted. This ensures that the government receives the tax amount promptly.

- For deductions made in March, the payment is due by April 7 of the following month. This is crucial, especially for year-end adjustments.

- Private Sector Deductors:

- For private entities, TDS is typically deposited quarterly. The due dates for filing TDS returns are structured to ensure timely compliance, which helps maintain a good standing with the tax authorities.

Penalty for Late Filing of TDS/TCS Returns

Filing TDS or TCS returns late can lead to significant financial consequences. Here’s a breakdown of the penalties:

Late Filing Fee (Section 234E)

- If you fail to submit TDS/TCS statements by the due date, a late filing fee of INR 200 per day will be charged until the statement is filed.

- Importantly, this fee is capped at the total amount of tax deductible or collectible, meaning you won’t pay more than what you owe in TDS.

Example:

Let’s say you deducted INR 5,000 as TDS on May 13, 2024, but you filed the return on November 17, 2024, missing the due date of July 31, 2024. The delay spans 109 days, leading to a potential fee calculation of:

- INR 200 x 109 days = INR 21,800.

However, since this exceeds your deducted amount, you will only pay INR 5,000.

Penalty (Section 271H)

- The Assessing Officer has the authority to impose a minimum penalty of INR 10,000 for failing to file TDS/TCS statements within the due date. This penalty can increase to INR 100,000 depending on the circumstances.

- This penalty also applies to cases of incorrect filings, emphasizing the need for accuracy in your submissions.

Exemptions from Penalty (Section 271H)

You may avoid penalties if:

- The tax deducted or collected at source is duly paid to the government.

- Any applicable late fees and interest are settled.

- The TDS/TCS return is filed within one year from the original due date.

Interest on Late Deposit of TDS

If TDS is not deducted or deposited on time, interest may be charged under the following provisions:

- Section 201(1A)(i): If TDS is not deducted when it should have been, a charge of 1% per month applies from the date it was due until it’s actually deducted.

- Section 201(1A)(ii): If TDS is deducted but not deposited with the government, a 1.5% per month interest charge applies until the amount is paid.

Example:

If you deducted INR 5,000 in TDS on January 13, 2024, but did not pay it until May 17, 2024, the interest would be calculated as follows:

- INR 5,000 x 1.5% x 5 months = INR 375.

Note: Interest is calculated monthly rather than daily, which can significantly affect the total amount owed if payments are delayed.

Prosecution for Non-Payment (Section 276B)

Failing to pay TDS to the Central Government is a serious offense that can result in imprisonment for a term ranging from three months to seven years, in addition to potential fines. This underscores the importance of timely payments and compliance with TDS regulations.

Penalty for Late Payment or Non-Payment of TCS

Under normal circumstances, failing to deposit TCS (Tax Collected at Source) on time can lead to penalties similar to those for TDS. The consequences can include both financial penalties and legal repercussions.

COVID-19 Penalty Provisions

During the COVID-19 pandemic, from March 20, 2020, to June 30, 2020, all penalty provisions were waived. However, it’s important to note that the usual rules and penalties apply under normal conditions.

This expanded version provides more comprehensive information while maintaining clarity and usability for readers. Let me know if you need any more adjustments or details

Related articles: Understanding TDS and TCS? , How to check TDS Refund Status?

Frequently Asked Questions (FAQ)

Q1. Is TDS paid on a monthly basis?

Yes! Any TDS deducted in a month must be paid by the 7th of the next month. For amounts deducted in March, the payment deadline extends to April 30

Q2. How do you calculate TDS on salary?

TDS on salary is determined by applying the relevant income tax slab to the employee's earnings, factoring in any applicable deductions and exemptions to ensure fair taxation.

Q3. Can I submit a TDS return after the due date?

Yes, you can, but be mindful of the penalties! If you file late, you’ll incur a fee of INR 200 for each day it’s overdue, as outlined in Section 234E. Additionally, you may face a penalty of at least INR 10,000 under Section 271H, which can escalate to INR 100,000 for significant delays.

Q4. What are Forms 24, 26, 27, and 27E?

These are specific forms required for TDS and TCS reporting:

- Form 24: For TDS on salary payments

- Form 26: For TDS on domestic non-salary payments

- Form 27: For TDS related to NRIs and foreign entities

- Form 27E: For reporting TCS details

Q5. What exactly is TDS?

TDS, or Tax Deducted at Source, refers to income tax that is withheld when making certain payments, like salaries, commissions, or rent. It ensures tax is collected upfront, making compliance easier.

Q6. Who is responsible for deducting TDS?

The entity making the payment, known as the deductor, is responsible for deducting TDS before completing the payment and must deposit it with the government.

Q7. Is TDS deducted from salary every month?

Yes, under Section 192 of the Income Tax Act, employers are required to deduct TDS from salaries that exceed the basic exemption limit on a monthly basis.

Q8. Is TDS calculated based on gross salary or CTC?

TDS is calculated on the **net taxable salary** after considering any deductions and allowances, rather than the entire Cost to Company (CTC).

Q9. Is TDS calculated on amounts that include GST?

No, TDS is calculated on amounts excluding GST, providing a clearer picture of your tax obligations.

Q10. What is the penalty for late filing of TDS returns?

If you file your TDS return after the deadline, you’ll face a fee of **INR 200 per day** until the return is submitted, but this will not exceed the total TDS amount deducted.

Q11. What is the interest for failing to deduct tax on time?

If TDS is not deducted when required, you’ll incur an interest charge of % per month on the tax amount from the due date until it is deducted.

Q12. What happens if I don’t pay the deducted tax?

If you fail to pay the tax after it has been deducted, you’ll be liable for an interest charge of 1.5% per month on the amount from the deduction date until payment is made.