Income Tax Refund status - How To Check Income Tax Refund Status For FY 2023-24 (AY 2024-25)?

What is an Income Tax Refund?

An income tax refund is a reimbursement from the government when you’ve overpaid your taxes during a financial year. This excess amount is returned to you after the tax authorities review your payments and liabilities.

For example, if a taxpayer pays Rs. 15,000 in taxes for the fiscal year 2023-2024 but has an actual tax burden of just Rs. 10,000, the Income Tax Department will reimburse Rs. 5,000 to the taxpayer. After filing and validating the income tax return, the department will start processing it. Once the return has been processed, the refund is typically credited to the taxpayer's bank account within four to five weeks.

How Does an Income Tax Refund Work?

1. Overpayment:Sometimes, taxpayers end up paying more tax than required through mechanisms such as:

- Tax Deducted at Source (TDS)

- Advance Tax Payments

- Self-Assessment Tax

2. Filing Your Return: When you file your income tax return (ITR), you report your total income, deductions, and the taxes you've already paid.

3. Assessment:The tax authorities then assess your return to determine your actual tax liability. This includes reviewing your claims for deductions, exemptions, and tax credits.

4. Refund Calculation: If the tax authorities determine that your actual tax liability is lower than what you’ve already paid, the excess amount is calculated as your refund.

5. Receiving the Refund:Once your return is processed and approved, the excess amount is refunded to you.

Note:To receive your income tax refund, you must complete the e-filing of your return. Ensure that all details are accurately filled out to avoid delays in processing.

If you've paid more taxes than you owe, you can request a refund for the excess amount. To track your refund status, simply use the Income Tax Department's online facility.

Here’s how:

1. Check Your Refund Status: Enter your PAN (Permanent Account Number) and the Assessment Year on the official portal to see the progress of your refund.

2. Refund Timeline: Refunds are usually processed within 4-5 weeks after e-verifying your return.

3. If Delayed:

- Review Your Return: Log in to the e-filing portal, go to "e-File" > "Income Tax Returns" > View Filed Returns to check for discrepancies.

- Check Your Email:Look for notifications from the Income Tax Department regarding your refund status.

- Track Your Refund:Use the online tools provided to monitor your refund progress.

How to Claim Your Income Tax Refund

1. File Your Income Tax Return:Submit your return with details of your income, deductions, and taxes paid.

2. Refund Calculation:The refund amount you’re eligible for will be automatically calculated and shown in your return.

Follow these steps to ensure you receive the refund you're due!

To receive an income tax refund, you must complete the e-filing process. Make sure you e-file this year to receive your tax refund sooner.

How to Easily Calculate Your Income Tax Refund

If you’ve paid more tax than you actually owe, you can get the extra amount back as a refund. Here’s a simple way to figure it out:

Refund Calculation:

Refund = Taxes Paid – Tax Liability

Steps to Calculate Your Refund:

1. Add Up Your Taxes Paid: This includes Advance Tax, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and Self-Assessment Tax.

2. Find Your Tax Liability:This is the total tax you actually owe for the year.

3. Subtract Your Tax Liability from Taxes Paid:This will give you the amount of your refund.

Example:

Let’s say Mr. Gupta paid ₹3,00,000 as advance tax. At the end of the year, he finds out his total tax liability is only ₹2,00,000. Here’s how to calculate his refund:

₹3,00,000 (Taxes Paid) - ₹2,00,000 (Tax Liability) = ₹1,00,000 (Refund)

What To Do Next:

File your Income Tax Return (ITR). The tax department will check your details, and if everything is correct, they’ll send the ₹1,00,000 refund to your bank account.

It’s that simple! Get started and claim your refund today!

How to Check Income tax Refund Status online for 2024-25?

If you are concerned about the status of your tax refund, you can verify it in three different ways, as described below.

1. Use the Income Tax Portal.

Step 1: Access the income tax portal and sign in to your account.

Step 2: Click on 'e-File', choose 'Income Tax Returns' and then select ‘View Filed Returns’

Step 3: You can see the status of your current and past income tax returns.

Step 4: Click on 'View details,' and you'll see the status of your income tax refund, as shown in the picture below.

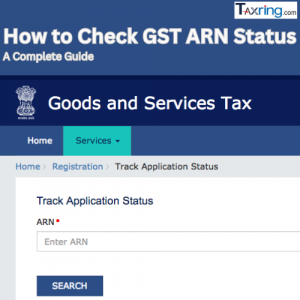

2. Through NSDL Portal

Step 1: Visit the NSDL Portal

Step 2: Enter your PAN details, select the Assessment Year from the drop-down option for which tax refund is awaited and enter the Captcha Code

Step 3: Click ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ option

You will be directed to a page that displays the ‘Refund Status’.

3. Through TRACES

Step 1: Log in to the income tax portal

Step 2: Click on ‘e-File’, select ‘Income Tax Returns’ and hit ‘View Form 26AS’

Step 3: You will be directed to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page, and Click on ‘View Tax Credit (Form 26AS/Annual tax statement) at the bottom of the page

Step 4: Select the Assessment Year from the drop-down menu, and select view as ‘text’

You are directed to a page that displays the details of the paid refund

Understanding Your Refund Status

Here’s a quick guide to help you understand what your refund status means and what steps you should take next:

1.No E-filing Done for Current AY

What This Means:

Your income tax return (ITR) might not have been filed for the current Assessment Year (AY).

What to Do Next:

- Verify the Assessment Year (AY) you checked. For example, Financial Year (FY) 2022-23 corresponds to AY 2023-24.

- If you haven’t filed your return, you need to do so as soon as possible.

2.Under Processing

What This Means:

The income tax department is still processing your return.

What to Do Next:

- Wait a month and check your status again to see if there are any updates.

3. Refund Issued

What This Means:

Your refund has been sent either via cheque or direct debit to the bank account you provided.

What to Do Next

- Check your bank account or mail for the refund.

4. Processed with No Demand No Refund

What This Means:

- You filed with neither a refund claim nor any tax due, so everything is settled for the year.

- Alternatively, you might have filed for a refund, but it was denied due to discrepancies or incomplete information.

What to Do Next:

- If you missed any deductions, you can revise your return.

- Check any notices from the income tax department for details and rectify any errors if needed. You may want to consult a tax expert for guidance.

5. Refund Failure

What is Refund Failure:

Your refund was not processed due to incorrect or unvalidated bank account details.

What to Do Next:

- Log in to [incometax.gov.in](https://incometax.gov.in) and update and validate your bank details.

- Apply for a ‘Refund Reissue’ after validating your account.

6. Case Transferred to Assessing Officer

What This Means:

The income tax department needs more information or clarification, or there might be outstanding taxes.

What to Do Next:

- Contact your Assessing Officer (AO) for further instructions.

7. Demand Determined

What This Means:

Your refund request was rejected, and you owe additional taxes.

What to Do Next:

- Review the intimation carefully and cross-check with your records.

- If you owe taxes, pay them within the specified time. If you believe there was a mistake, update your information and file a rectification. You might want to consult an expert for help.

8.Rectification Processed Refund Determined

What This Means:

Your rectified return has been processed, and a refund has been determined and credited.

What to Do Next:

- Expect a revised intimation detailing the refund amount.

9. Rectification Processed Demand Determined

What This Means:

Even after rectifying your return, you still owe taxes.

What to Do Next:

- Pay the outstanding amount within 30 days of receiving the notice.

- If you believe there’s an error, review and update your information, and file a rectification. Consult an expert if needed.

10. Rectification Processed No Demand No Refund

What This Means:

After rectifying your return, no additional tax is due, and you’re not eligible for a refund.

What to Do Next:

- You will receive a revised intimation confirming this status.

For further assistance, you may consult a tax expert who can guide you through resolving issues and filing rectifications if necessary.

Is Your Income Tax Refund Taxable? Here’s What You Need to Know

Refund Basics:

Good news—your income tax refund itself is not taxable! 🎉 However, any interest you earn on the refund amount is subject to tax according to your applicable tax slab. So, while you won’t be taxed on the refund amount, keep an eye on any interest you might receive.

How Long Does It Take to Get a Tax Refund?

The time it takes to get your tax refund can vary, but here’s a general timeline:

- Average Time: About 90 days after e-verification of your return.

- Faster Processing: The Income Tax Department has improved its system, reducing the average processing time. For returns filed in AY 2023-24, the processing time is now around 10 days—much faster than previous years!

How Will You Receive Your Refund?

Your refund will typically come through:

- Electronic Transfer: Directly credited to your bank account.

- Refund Cheque:Mailed to the address you provided in your return.

Make sure you enter the correct bank account number, IFSC code, and complete address (including PIN code) when filing your return to avoid delays.

Interest on Your Refund:

If your refund is more than 10% of the total tax payable, you’ll earn simple interest at a rate of 6% per annum. This interest is calculated from the start of the next financial year until the date you receive your refund.

Missed the ITR Filing Deadline?

Don’t worry! If you missed the 31st July 2024 deadline for filing your ITR, you can still file a belated return until 31st December 2024 to claim your refund.

Need Help with Your Refund?

For any refund-related questions or issues, you can reach out to:

- Aaykar Sampark Kendra: Call 1800-180-1961 or email refunds@incometax.gov.in

- CPC Bangalore Queries: Contact 1800-425-2229 or 080-43456700 for refund records.

- Payment Queries: Call the SBI Contact Centre at 1800-425-9760.

Stay informed and keep track of your refund status to ensure everything is processed smoothly!

Related Articles:

How to file ITR after the deadline

What are the reasons for Refund Failure?

Income tax Audit under section 44AB

What is a Belated Return & How to file a Belated Return ?