Income Tax Budget 2024: New Tax Slabs to Standard Deduction - Changes Under New Regime You Need to Know

Income Tax Budget 2024 On July 23, Finance Minister Nirmala Sitharaman unveiled the Budget 2024. The FM blazoned a borderline income duty cut for the middle class. She increased the standard deduction( a fixed deduction from a hand's total payment before calculating the applicable income duty rate) by 50 to ₹ 75,000 and acclimated duty crossbeams for taxpayers under the new income duty governance. Speaking on the budget, Prime Minister Narendra Modi stated that it" will act as a catalyst in making India the third- largest frugality in the world( from fifth largest moment) and will lay a solid foundation for a developed India.

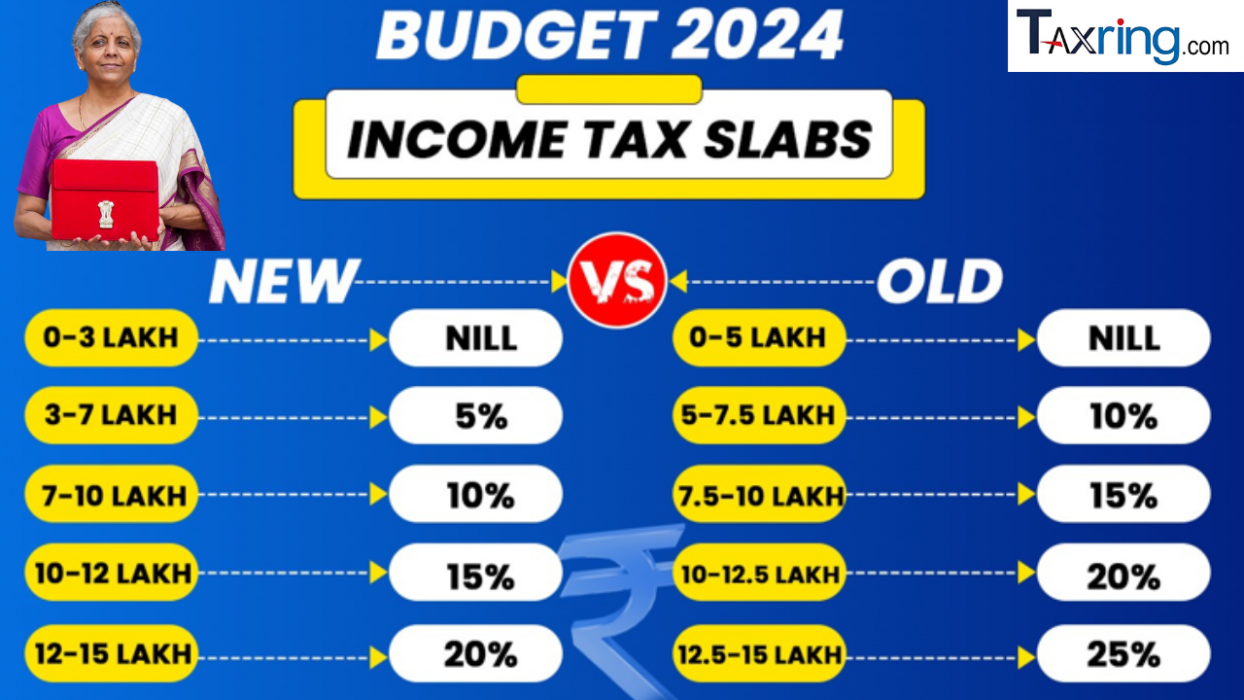

The income tax slabs differ between the previous and current tax regimes. Furthermore, the slab rates under the previous tax regime were divided into three groups.

- Indian residents under 60 years and non-residents aged 60 to 80 years:

- Resident Senior Citizens

- More than 80 years: Resident super seniors

Income Tax Budget 2024: Tax Slabs Under the New Regime

The Budget 2024 altered the tax slabs in the New Regime, giving taxpayers an additional opportunity to save Rs 17,500 in taxes. Furthermore, the standard deduction has been enhanced to Rs. 75,000 under this regime, while the family pension deduction has been adjusted to Rs. 25,000 from Rs. 15,000. This is applicable for the fiscal year 2024-25. The following is a comparison of the tax slabs after and before the budget:

|

Tax Slab for FY 2023-24 |

Tax Rate |

Tax Slab for FY 2024-25 |

Tax Rate |

|

Upto ₹ 3 lakh |

Nil |

Upto ₹ 3 lakh |

Nil |

|

3 lakh - ₹ 6 lakh |

5% |

3 lakh - 7 lakh |

5% |

|

6 lakh - 9 lakh |

10% |

7 lakh - 10 lakh |

10% |

|

9 lakh - 12 lakh |

15% |

10 lakh - 12 lakh |

15% |

|

12 lakh - 15 lakh |

20% |

12 lakh - 15 lakh |

20% |

|

More than 15 lakh |

30% |

More than 15 lakh |

30% |

Income Tax Budget 2024: New income tax regime vs old current old tax slab rates compared

New income tax vs. old income tax slabs: On July 23, Finance Minister Nirmala Sitharaman presented the Narendra Modi 3.0 government's first budget. FM increased the standard deduction by 50% to ₹75,000 and adjusted tax slabs under the new income tax regime to benefit salaried individuals. The new tax slabs under the new income tax regime will be implemented from April 1, 2024 (Assessment Year 2025-26).

According to Sitharaman, income up to ₹3 lakh will remain exempt from income tax under the new regime.

The proposed tax rates are as follows: 5% for income between ₹3-7 lakh, 10% for ₹7-10 lakh, and 15% for ₹10-12 lakh.

However, 20% tax would continue to be charged on income between ₹12-15 lakh, and 30% on income above ₹15 lakh.

The new I-T regime levies a 5% tax on income between ₹3-6 lakh and 10% on income between ₹6-9 lakh.

Income of ₹9-12 lakh and ₹12-15 lakh is subject to 15% and 20% tax, respectively. Income beyond ₹15 lakh would be subject to a 30% income tax.

Income Tax Budget 2024: New regime tax slabs

| 0 - 3 Lakh | Nill |

| 3 - 7 Lakh | 5% |

| 7 - 10 Lakh | 10% |

| 10 - 12 Lakh | 15% |

| 12 - 15 Lakh | 20% |

| Above 15 Lakh | 30% |

Income tax slabs Budget 2024: Finance Minister Nirmala Sitharaman leaves old tax regime unchanged

FM Sitharaman's Budget 2024-25 contains tax measures that benefit salaried individuals. The new system increases the standard deduction to ₹75,000 and revises tax slabs by up to 30%. The old regime has not changed.

1) Income up to ₹2.5 is exempt from taxation under the old tax regime.

2) Income between ₹2.5 to ₹5 lakh is taxed at the rate of 5 percent under the old tax regime.

Income Tax Budget 2024 LIVE :Changes in capital gains tax

Changes in capital gains taxes

STCG increased to 20%.

LTCG increased to 12.5% from 10%.

Income Tax Budget 2024: New tax rate on short-term gains from certain financial assets

Income Tax Budget 2024: Short-term profits on some financial assets will be taxed at 20%, while the rest will be taxed at the appropriate rate.

Income Tax Budget 2024: New tax rate on long-term gains from certain

Income Tax Budget 2024 is LIVE: The increase in STT rates for derivatives to 0.1% and futures to 0.02% may not be well received by investors. Furthermore, an increase in capital gains for listed equities instruments to 12.5% will disappoint investors. Proposing to tax buy-back revenues as dividends may also offer issues because the buy-back option is chosen not just for profit distribution but also for internal restructuring." CA Pitam Goel, Co-Founder of Tattvam Group remarked

Income Tax Budget: Key income tax changes

Significant income Duty adaptations The standard deduction for salaried workers increased from ₹ 50,000 to ₹ 75,000. Pensioners can now abate ₹ 25,000/- from their family pension, over from ₹ 15,000. The 5% duty rate arbor increased from ₹ 5 lakh to ₹ 7 lakh. NPS- The benefit for social security of paid persons can accrue as a deduction of expenditure by employers towards NPS( the new pension system is intended to be enhanced from 10 to 14 percent of the hand's payment).

Income Tax Budget 2024 LIVE: FM Sithraman on TDS, TCS

Income Tax Budget 2024 LIVE: 2% TDS is being withdrawn on Mutual funds

Credit of TCS is proposed to be given in salary

Standard operating procedure of TDS procedure

Frequently Asked Questions

Income Tax Budget 2024: What is the latest standard deduction for salaried employees?

Income Tax Budget 2024 is LIVE: Budget 2024 increased the standard deduction for salaried employees to 75,000 rupees from 50,000 rupees previously.

Q.How should I compute income tax for Fiscal Year 2023-24?

Ans.For fiscal year 2023-2024, taxpayers can choose between two tax regimes: the old or the new. The income tax should be calculated using the appropriate slab rates.

Q2.Can I claim 80C deductions and switch to a new income tax slab system?

No, the new tax scheme eliminates several deductions and exemptions that were previously accessible. Deductions under section 80C cannot be claimed if the taxpayer opts for a new tax regime.

Q3.How does the government collect its taxes?

The government collects taxes through three means:

Taxpayers make voluntary payments through several approved banks. Examples of tax payments include advance and self-assessment, TDS, and TCS.

Q4.How to file an income tax return online?

To file your income tax return online, visit either the income tax e-filing portal or Taxring Log in to www.incometax.gov.in to file your taxes electronically. You can also use the offline JSON utility to file the ITR. Remember to validate your return within 30 days of filing the ITR. ITR submission is incomplete without verification; failing to validate the return will result in the return being deemed not submitted at all.

Please click here to read a step-by-step guide on how to e-file ITR on the income tax e-filing website.

Q5.How much tax do I have to pay if my income is five lakh?

No tax is due because tax rebates are provided up to Rs. 5 lakh under the old regime and Rs. 7 lakh under the new regime.

Q6.If my income is 10 lakh, how much tax do I have to pay?

New Regime: 62,400

Old Regime: 1,17,000

Read also: