Blogs

Read the latest articles, blogs, case studies, and many more on Taxation, GST, Company Compliances, etc. published on Taxring.com Pvt. Ltd. by our experts.

What are the Personal Income Tax Reforms for Middle class and more in 2025 Budget?

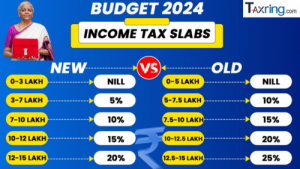

The government has introduced revised income tax slabs under the new tax regime to make taxation more streamlined and beneficial for middle-class earners.

Read moreOctober 2024: Key Changes & New TDS Rate Chart in India

The Union Budget 2024 has introduced significant updates to the Tax Deducted at Source (TDS) framework, effective from today, October 1, 2024. These changes affect various transactions, from rent paym ...

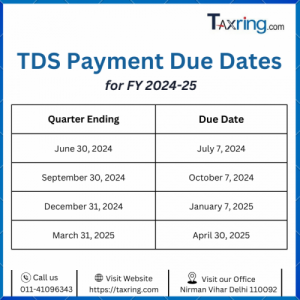

Read moreTDS Payment Online:Due Dates for TDS Return FY 2024-25

One of the most significant compliance obligations for Indian enterprises and people is Tax Deducted at Source (TDS). In addition to causing several issues with the efficient financial operatio ...

Read moreLLP Registration: Limited Liability Partnership Registration in India

In India, a Limited Liability Partnership (LLP) is a unique type of business entity that combines the features of corporations and partnerships. It is regulated under the Limited Liability Partnership ...

Read moreIncome Tax Budget 2024: New Tax Slabs to Standard Deduction - Changes Under New Regime You Need to Know

Income Tax Budget 2024 On July 23, Finance Minister Nirmala Sitharaman unveiled the Budget 2024. The FM blazoned a borderline income duty cut for the middle class. She increased the standard deducti ...

Read moreGet the latest update on the New tax regime

Old vs New Tax Regime: Which Is Better New Or Old Tax Regime For Salaried Employees?

Read moreIncome Tax Slabs FY 2023-24 & AY 2024-25: New & Old Rates

the Income duty is levied on people using an arbor system, with different duty rates assigned to different income situations. duty rates rise in proportion to an existent's income. This kind of ...

Read moreIncome Tax Return Filing Charges & Expert Consultation | Taxring Who Should File an Income Tax Return?

The Income Tax Return( ITR) is a form that you must file with the Income Tax Department of India. It indicates how important you made and how important you owe in levies for the time. The fiscal t ...

Read more

(1)-300x300.png)

-300x300.png)