Blogs

Read the latest articles, blogs, case studies, and many more on Taxation, GST, Company Compliances, etc. published on Taxring.com Pvt. Ltd. by our experts.

What are the Personal Income Tax Reforms for Middle class and more in 2025 Budget?

The government has introduced revised income tax slabs under the new tax regime to make taxation more streamlined and beneficial for middle-class earners.

Read moreTDS and TCS Rationalization in Union Budget 2025: A Simplified Tax Regime

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, introduced several key reforms to simplify India’s tax structure.

Read moreWhat is Integrated Goods and Services Tax? GST complete guide

The Goods and Services Tax (GST) is a transformative indirect tax system that began in India on July 1, 2017. It replaced several central and state-level taxes, such as VAT, service tax, and excise du ...

Read moreGST Payment Status: How to Track your GST Payment online ?

India's Goods and Services Tax (GST) system makes it simple for companies to pay taxes online. To prevent fines or compliance problems, it is crucial to confirm that your GST payments have been comple ...

Read moreHow to Check GST ARN Status: A Complete Guide

If you’re applying for GST registration in India, a critical aspect to monitor is your GST ARN status. The Application Reference Number (ARN) is a unique identifier assigned to each GST registration a ...

Read moreBenefits of Online Income Tax Filing: A Hassle-Free e file login Guide

Filing your Income Tax Return (ITR) on the Income Tax portal is a simple process. Start by visiting the official website and logging in with your PAN and password. Choose the correct assessment year a ...

Read moreSurrender Duplicate PAN Card: A Complete Guide

A duplicate PAN (Permanent Account Number) card is issued by the Income Tax Department of India when an individual loses their original PAN card or it is damaged. The duplicate card serves the same pu ...

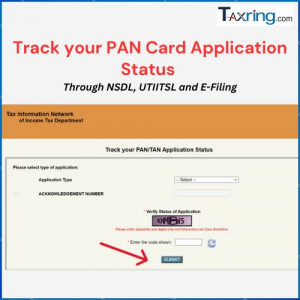

Read moreHow to track Your Status of Pan Card Online

A PAN (Permanent Account Number) card is essential for Indian taxpayers and serves as a unique identifier for individuals and entities. Checking the status of your PAN card application is crucial to e ...

Read morePan Card Application Form PDF: How to fill pan card form..

A PAN (Permanent Account Number) is a unique 10-digit alphanumeric identifier provided by the Income Tax Department of India that is required for many financial operations, including filing income tax ...

Read moreGSTR-3B Due Dates for Quarterly Returns: Ensure Timely Filing in 2024

In the ever-evolving landscape of Goods and Services Tax (GST) compliance in India, GSTR-3B stands as a crucial return that taxpayers must file regularly. This blog provides a detailed overview of GST ...

Read more

-300x300.png)