Blogs

Read the latest articles, blogs, case studies, and many more on Taxation, GST, Company Compliances, etc. published on Taxring.com Pvt. Ltd. by our experts.

Income Tax Slabs FY 2023-24 & AY 2024-25: New & Old Rates

the Income duty is levied on people using an arbor system, with different duty rates assigned to different income situations. duty rates rise in proportion to an existent's income. This kind of ...

Read moreWhat is Capital Gains Tax in India? types, rates, and savings

Investing in a residential property is one of the most popular investments, partly because you get to own a home. Others may invest with the purpose of profiting from the property when they sell it la ...

Read moreITR Filing Last Date FY 2023-24 (AY 2024-25)

Income Tax Return Filing Deadline for for the financial year 2023-24 (assessment year 2024-25) (assessment year 2024-25) is July 31, 2024. Filing after this date will incur interest charges under Sect ...

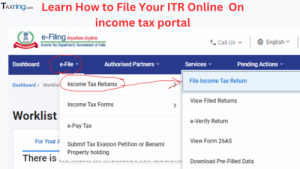

Read moreHow To File ITR Online: A Step-by-Step Guide to E-filing Income Tax Returns for FY 2023-24 (AY 2024-25)

An Income Tax Return (ITR) is a vital document that records your financial transactions, including income, expenses, deductions, investments, and taxes. As per the Income-tax Act of 1961, filing ITR i ...

Read moreWhat is Digital Signature Certificate Online complete guide

A Digital Signature Certificate (DSC) is an essential requirement for submitting various online forms to the Government of India. It serves the critical purpose of electronically signing documents, em ...

Read moreWho Should File ITR for FY 2023-24? Income Tax Login

Income Tax Returns (ITR) must be filed annually by individuals and entities meeting specific income thresholds set by tax authorities. Filing ensures compliance with tax laws and facilitates accurate ...

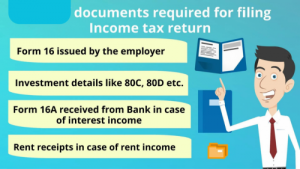

Read moreMust-Have Documents for Smooth Income Tax Return (ITR) Filing in India FY 2023-24 (AY 2024-25)

Income Tax is a levy imposed on individuals and entities based on their earnings and profits. For the financial year 2023-24 (Assessment Year 2024-25), the deadline to file income tax returns is 31st ...

Read moreWhat is Annual Information Statement (AIS) How to Check AIS Status, AIS Password and Feedback

Explore the importance and impact of the Annual Information Statement (AIS) provided by the IT Department for insightful financial management and compliance.

Read moreForm 16 for FY 2023-24: Generation, Understanding, and Downloading

Form 16 Download: Find out what is form 16, how to get form 16, how to download form 16 online and when form 16 will be generated for 2022-23? Know about form 16A and form 16B. Upload your Form 16 and ...

Read moreCheck Your Income Tax Refund Status FY 2023-24 (AY 2024-25)

Get timely updates on your income tax refund status with the Income Tax Department's online tracking system. Simply enter your PAN (Permanent Account Number) and the relevant Assessment Year to monito ...

Read more-300x300.png)

-300x300.png)

-300x300.png)

-300x300.png)

(1)-300x300.png)

-300x300.png)