Blogs

Read the latest articles, blogs, case studies, and many more on Taxation, GST, Company Compliances, etc. published on Taxring.com Pvt. Ltd. by our experts.

GST Return Filing: Complete Guide Due Date Who should file?

One of the key features of the GST era is the consolidation of most indirect taxes, which previously required separate returns from various businesses. Now, whether you are a trader, manufacturer, res ...

Read moreDiscover the Best Corporate Tax Rate in India Today

Corporate tax Rate in India is a vital element of business finance that impacts companies across all sizes and industries. This tax is levied on a corporation's profits, making it crucial for effectiv ...

Read moreWhat is an Audit Report? Types & Format Explained

Tax audit: The deadline for submitting an income tax audit report is October 7, 2024, for fiscal year 2023-24 (AY 2024-25). If you fail to submit your tax audit report by October 7, 2024, you will fac ...

Read moreOctober 2024: Key Changes & New TDS Rate Chart in India

The Union Budget 2024 has introduced significant updates to the Tax Deducted at Source (TDS) framework, effective from today, October 1, 2024. These changes affect various transactions, from rent paym ...

Read moreTax Audit Due Date FY 2023-24: Who Must File?

Certain taxpayers are required to conduct income tax audits as mandated by income tax law. This audit involves a comprehensive review of the taxpayer’s books of accounts and financial records, specifi ...

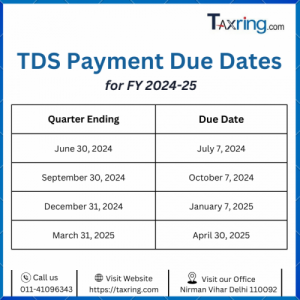

Read moreTDS Payment Online:Due Dates for TDS Return FY 2024-25

One of the most significant compliance obligations for Indian enterprises and people is Tax Deducted at Source (TDS). In addition to causing several issues with the efficient financial operatio ...

Read moreExpert Help for Income Tax Notices: Types and Solutions

The Income Tax Department issues notices for reasons like missing returns, filing errors, or additional information requests. While a notice might seem alarming, it's important to understand its natur ...

Read moreTDS and TCS Under GST: A Comprehensive Guide for Businesses

The Goods and Services Tax (GST) regime in India introduces several mechanisms for efficient tax collection and compliance. Among these, Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) ...

Read moreBooks of Accounts Under Section 44AA: An Essential Record-Keeping Guide

Books of Accounts Under Section 44AA: An Essential Record-Keeping Guide Maintaining accurate books of accounts is crucial for compliance with tax regulations in India. Section 44AA of the Income Ta ...

Read more

-300x300.png)

-300x300.png)

-300x300.png)