Blogs

Read the latest articles, blogs, case studies, and many more on Taxation, GST, Company Compliances, etc. published on Taxring.com Pvt. Ltd. by our experts.

LLP Registration: Limited Liability Partnership Registration in India

In India, a Limited Liability Partnership (LLP) is a unique type of business entity that combines the features of corporations and partnerships. It is regulated under the Limited Liability Partnership ...

Read moreHow to Register Your MSME: A Simple Udyam Registration Guide

Udyam Registration is the streamlined process for MSMEs to obtain official recognition, unlock government benefits, and enhance business growth opportunities

Read moreIncome Tax Refund status - How To Check Income Tax Refund Status For FY 2023-24 (AY 2024-25)?

An income tax refund is a reimbursement from the government when you’ve overpaid your taxes during a financial year. This excess amount is returned to you after the tax authorities review your payment ...

Read moreGST Registration Online: Documents Required, Limits, Fees, Process, and Penalties

GST (Goods and Services Tax) is a single tax system that streamlines your business operations. GST allows you to manage your taxes online, easily, and transparently. Say good-bye to multiple taxes and ...

Read moreIncome Tax Audit Under Section 44AB of the Income Tax Act 1961

A tax audit is an inspection and assessment of an organization's books of accounts for business or profession. A tax audit examines transactions involving income, expenses, deductions, and the organiz ...

Read moreBelated Return under Section 139(4): Due Date, Penalty and How to File?

A belated return under Section 139(4) of the Income Tax (I-T) Act is one that is filed after the deadline. Taxpayers who failed to file a return on or before July 31 may file a late return. People ...

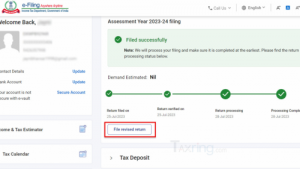

Read moreHow to Revised Income Tax Return: Section 139(5)

Filing your Income Tax Return (ITR) correctly is critical for a number of reasons. Inaccuracies might cause delays in processing, requests for additional tax payments, or penalties. Underreporting inc ...

Read moreHow to Respond to a Defective Return Notice?139-(9)

If the return is lacking crucial information or was incorrectly recorded in the ITR, a faulty return notification can be issued under Section 139(9). It is common to omit information or make errors ...

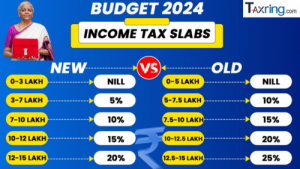

Read moreIncome Tax Budget 2024: New Tax Slabs to Standard Deduction - Changes Under New Regime You Need to Know

Income Tax Budget 2024 On July 23, Finance Minister Nirmala Sitharaman unveiled the Budget 2024. The FM blazoned a borderline income duty cut for the middle class. She increased the standard deducti ...

Read moreGet the latest update on the New tax regime

Old vs New Tax Regime: Which Is Better New Or Old Tax Regime For Salaried Employees?

Read more (1)-300x300.png)

-300x300.png)

-300x300.png)

-300x300.png)